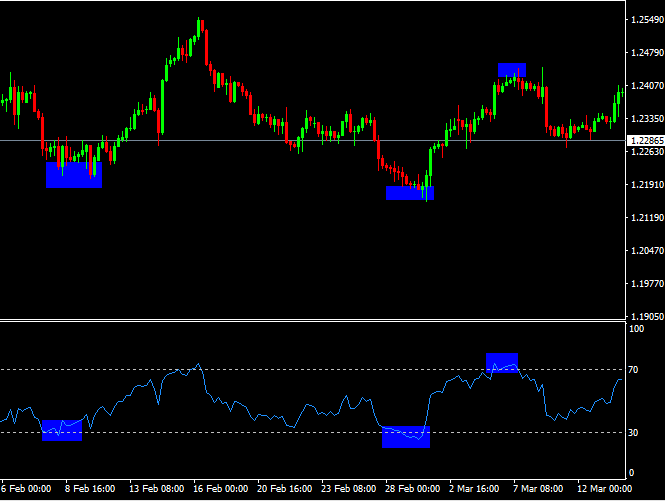

Should You Rely on RSI in Forex?

The Relative Strength Index is probably one of the most popular price indicators and it is being used by those traders who are at the beginning with forex trading. However, the indicator might be misleading for most of the traders, as they fail to understand it properly, which leads to some painful mistakes. In this … [Read more…]