TRADE.com Highlights

TRADE.com is a trade name operated by Trade Capital Markets (TCM) Ltd, which is regulated by CySEC and South Africa’s FSCA, and by Livemarkets Limited, it’s authorized and regulated in the United Kingdom by the Financial Conduct Authority (FCA).

Since the brand follows very strict guidelines with regards to clients’ funds and the highest standard of account management service, TRADE.com has built itself a solid reputation in the online trading industry.

Its services cover CFDs, Thematic Portfolios, IPOs, and Asset Management. This TRADE.com review will focus mainly on the forex and CFDs offer since that’s one of the most demanded offers at present.

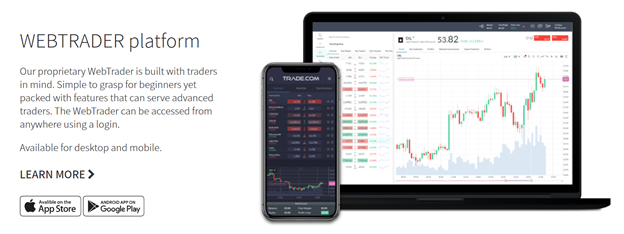

Trading Software

One of the best news for traders wanting to work with TRADE.com comes from the fact that the broker supports multiple platforms. We should first talk about WebTrader, the proprietary platform that is constantly upgraded by the broker.

The latest generation includes multi-chart display windows with independent chart functions, mobile compatibility, integrated tools like Trading Central, Events & Trade, and others, secure management tools, style and chart settings, and invaluable access to online assistance 24/5. With the WebTrader, you can trade on more than 2,1000 CFDs, covering a broad range of markets.

On top of it, TRADE.com also provides access to the popular MetaTrader 4, through both desktop and mobile interfaces. Since it has a good reputation, many traders will choose to use the MT4, thanks to a set of features such as automated trading, alerts, and other customization tools.

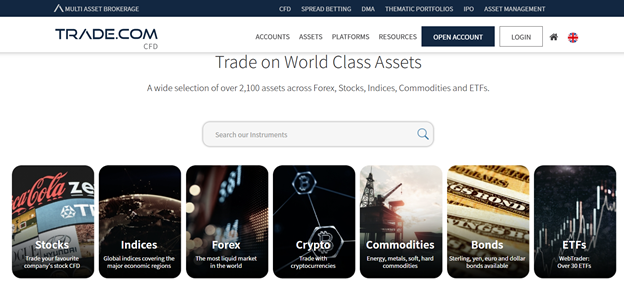

TRADE.com Assets

If we talk about the CFD assets available with TRADE.com, their offer includes more than 2,100 instruments, including Forex, stocks, indices, commodities, ETFs, bonds, and crypto.

You can go long or short on any of the assets, with spreads starting from as little as 0.4 pips, depending on the account type chosen.

The TRADE.com forex offer stands out, considering there are 55 currency pairs available for trading 24/5, tight spreads, and flexible leverage, depending on the type of clients. Compliant with the latest European regulation, the broker splits clients into Retail and Professional. For retail traders, the maximum leverage for forex is 1:30, while professionals benefit from up to 1:300 leverage.

Aside from forex CFDs, clients can diversify with stocks, indices, or ETFs. At the same time, they can invest in commodities or some of the most popular cryptocurrencies. Lastly, the offer includes some of the top bonds in the world, in case traders want exposure on this market, generally popular among institutional investors.

Account Types

Starting to trade with TRADE.com is very convenient, considering a Micro account can be opened with as little as $100. To ensure a broad diversification, the offer includes Silver, Gold, Platinum, and Exclusive accounts. In exchange for larger deposits, clients will benefit from enhanced trading conditions, including tighter spreads, daily analysis, Events & Trade, dedicated account manager, premium daily analysis, and other helpful features.

Access to the popular Trading Central, a top technical analysis tool currently trending among retail traders, is not ensured for Micro and Silver account holders. Only traders that can qualify for a Professional account will be able to benefit from enhanced trading conditions.

For customers based in the UK, who want to benefit from a capital gains tax exemption and no stamp duty payable, TRADE.com also offers Spread Betting accounts. They can spread bet across forex, commodities, stocks, and cryptocurrencies, with leverage and low commissions, via a user-friendly platform.

Education

Depending on the account type chosen, traders working with TRADE.com can benefit from a multitude of educational resources.

Premium daily analysis, assistance from an account manager, access to the Trading Central, and others are available. We must emphasize Trading Central, because that is currently one of the most efficient technical analysis tools, and thankfully, it is available with TRADE.com, as well.

TRADE.com Conclusion

Considering it is a well-established brand, which is regulated by a number of respected financial regulators around the world, TRADE.com is without a doubt one of the more trusted brokers currently active in the market.

It had managed to achieve consistency by offering high-quality services for years in a row, and in the meantime, had managed to accumulate a large customer base.

If you want to trade CFDs or spread bet with TRADE.com, we are glad to say this is a broker you can trust. For more information on what it can offer, feel free to check the official website. That’s where you can see things in greater detail, or get in touch with one of the representatives.

HIGH RISK INVESTMENT WARNING: Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

TRADE.com Review

Product Name: TRADE.com

Product Description: TRADE.com has built itself a solid reputation in the online trading industry. Its services cover CFDs, Thematic Portfolios, IPOs, and Asset Management. This TRADE.com review will focus mainly on the forex and CFDs offer since that’s one of the most demanded offers at present.

Brand: TRADE.com

Offer price: 100$

Currency: EUR / USD

Offer URL: https://www.trade.com/

-

Trading Platform

-

Languages

-

Spread

-

Support

Summary

TRADE.com has built itself a solid reputation in the online trading industry.

Its services cover CFDs, Thematic Portfolios, IPOs, and Asset Management. This TRADE.com review will focus mainly on the forex and CFDs offer since that’s one of the most demanded offers at present.

Pros

- A multi-assets online trading brand, providing access to a multitude of trading services.

- Proprietary web platform and MetaTrader 4 currently available.

- Reliable customer support available via multiple communication channels, 24/5.

Cons

- Trading Central is not available for Micro and Silver account holders.

- Spreads are very competitive only for large account holders.