The market order means that the trade will be executed immediately. Your buy order will be filled at the Ask price and your sell order will be executed at the Bid price as soon as your order hits the market. During quite times most often your market order will be executed at the price you see on your screen. But during fast moves, your order might get filled tens of pips away from where you expected to enter. This happens because a flood of orders enter the market at the same time and they get executed on the first-come-first-serve basis.

1) Limit order

2) Stop order

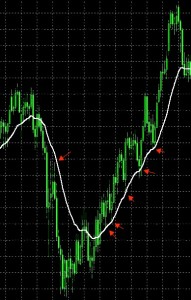

1) Limit order means that you set the exact price at which you want to buy or sell. This types of orders are useful when you want to enter a trade at a certain level on a rebound. In the picture below you can see that when the price dropped there was a good opportunity to go short if you placed a Sell Limit order near the white line on the graph (this line will be explained in the future). Also, there were numerous opportunities to enter long or add to a long position on the way up. The way to do that would be to place Buy Limit orders along the white line.

The problem with limit orders is that the price might not reach it a few pips or, when you trade multiple lots, not all lots get filled. For example, you wanted to buy 3 lots but at that price traded just one lot and then the price went back.

2) Stop order means that your order becomes a market order once the price reached your stop level. Just the same as with the market order, the price at which the order is executed might differ from the price you set. Still placing a stop order gives you an advantage of being in the books before any market orders come in for execution.

I use stop orders both for entering and for exiting the market.

Slippage

Slippage is the difference between the expected and the actual prices. Sometimes the slippage works for you when you exiting the trade on a wave of a strong move. But most of the times the slippage is an expense, which comes out of your pocket. This is a reality of life that one has to live with. But be aware that for dishonest brokers the slippage is also an excuse to stiff you out of extra dollars.

Ways to avoid slippage:

a) before opening an account seek experiences of other traders with this Forex broker/dealer;

b) be aware of significant technical levels where most traders place their orders;

c) when placing your stop orders allow a couple of extra pips for slippage. It is not uncommon to get a fill on a stop order a pip higher or lower than the highest or the lowest price of that time period. Missing a major move because you placed you stop order a pip or two too close is very disappointing. But even more disappointing is getting bumped off at the price that was not even registered.