Month: March 2014

Tu., Mar. 11 overnight trade result: +23 pips

The EURUSD sell order that I published last night reached the first profit target. I moved stop loss orders for the remaining 2 units to the break even price and these stops got filled today. The total profit for this trade is +23 pips in the bank. Today is another slow day in the market but … [Read more…]

Mar. 7, End of week results: +201 pips (total: +2477 pips)

This week’s profit is +201 pips and the total up to date trading results for this blog are as follows: Week 1: +231 pips Week 2: – 19 pips Week 3: +415 pips Week 4: +366 pips Week 5: +137 pips Week 6: +150 pips Week 7: + 20 … [Read more…]

Fr., Mar. 7 end of day results: +96 pips

Today was another confirmation that technical analysis does work. The USD went up on the news and created some profits for those who were prepared to capitalize on the move. The results of trades today were as follows: GBPUSD: although the trade was correct, the wiggling of the price made me uneasy and I closed … [Read more…]

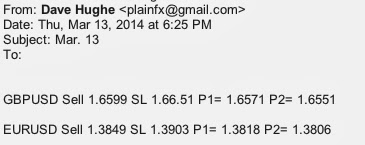

Fr., Mar. 7

Big news are coming out at 8:30 today and it looks like the market is expecting the news to be bad for the US dollar. On the other hand there are divergences in many major pairs and at least a temporary reverse in the price direction is due. But the problem is that it’s impossible … [Read more…]